|

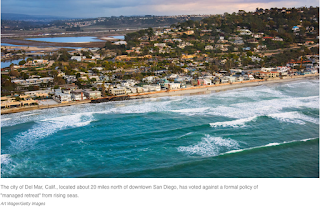

| Threatened by rising sea level |

"Our homes have become sanctuaries — places of refuge in the time of coronavirus. But they can't protect us from all threats.

Analysts

say the houses we've built, and where we've built them, could increase

our future vulnerability as we face the ongoing effects of climate

change.

|

Analysts fear insurers may withdraw

from areas they don't believe

are profitable.(ABC News: Tim Swanston) |

With increased damage to houses through

catastrophic fires, floods and other disasters, the global insurance

market is under increasing stress, and there are fears whole communities

could become impoverished or homeless.

Experts

doubt industry players and governments have fully come to terms with the

issue — and they worry about some of the financial mechanisms insurance

companies have put in place to share the risk.

Too focused on past catastrophes

Insurers

have a short-term focus and often fail to be proactive in assessing

future problems, according to Jason Thistlethwaite, a Canada-based

academic and expert on insurance practice.

He says

while global climate models are forward looking, the actuarial practices

used for risk modelling in the insurance industry are not.

Put bluntly, insurers still spend most of their time looking in the rear-view mirror.

|

| Erosion could cost some homeowners their entire asset, experts warn.(ABC RN: Antony Funnell) |

Where

there has been a shift in attitude, though, is among "reinsurers" —

essentially, the insurance companies for insurance companies.

"Reinsurers

are starting to grasp that these extreme events are something known as

correlated risk, meaning that there is a common cause underlying them,"

Professor Thistlethwaite says.

"So, Australia may

have a good year with very few claims in the primary insurance market,

but reinsurance rates may still go up because there is bad flooding in

the Philippines or the United Kingdom, for instance.

"They

are operating at a global scale that allows them to pick up on data

points that provide a much more coherent pattern that shows extreme

weather events are getting worse and contributing to higher losses."

He says that broader, interconnected understanding of

risk is starting to filter down to primary insurers, as they themselves

experience increasing reinsurance costs.

Nevertheless,

he's predicting a rationalisation of the primary insurance market, with

some companies going bust and others simply withdrawing from areas they

don't believe profitable.

Rise of the 'red zones of risk'

Professor

Thistlethwaite says it's already happening in the United States in

regions regularly affected by major climate-related events, such as

hurricanes and tornados.

And it's also beginning to occur in Australia, according to Karl Mallon, director of science at the organisation Climate Risk.

"If

we see emissions continuing in the current direction, the level of

warming continuing in the same direction, and if we continue to see a

sort of blind attitude to what's happening, then our risk will rise to

about one in 10 properties," he says.

"Ninety per

cent of properties may be OK, as in they are still insurable, even

though the costs might be elevated. [But] one in 10 may really cross into the red zone territory."

Early last year the

Insurance Council of Australia accused Dr Mallon of "scaremongering",

but its president Richard Enthoven has since acknowledged that changing

weather systems could potentially make some parts of Australia

"uninsurable".

Dr Mallon cites parts of the Gold

Coast in Queensland, the Central Coast in New South Wales, and West

Lakes in South Australia as regions facing an impending crisis.

Legal

expert Justine Bell-James warns that coastal communities could face a

double hit: not only could their houses become uninsurable, but some

homeowners could lose their entire asset due to erosion."

|

| The eroding sea at Wamberal NSW. |

Read the excellent complete ABC article

14 May2020

Related:

14 May2020

Related:

No comments:

Post a Comment