"Home sales in areas most vulnerable to sea-level rise began falling around 2013, researchers found. Now, prices are following a similar downward path."

|

In Florida, home sales in areas at high risk from sea-level rise have fallen compared to areas at low risk. |

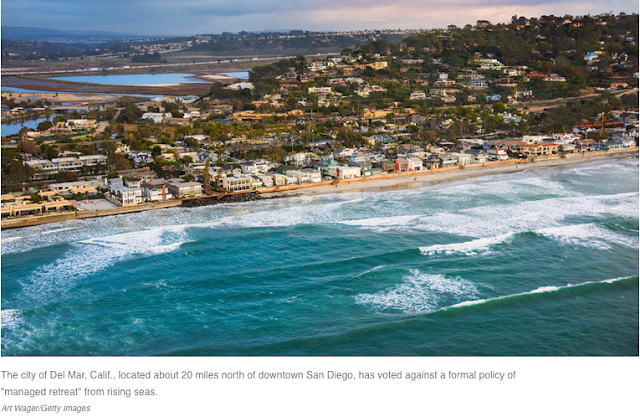

"The idea that climate change will eventually ruin the value of coastal homes is neither new nor particularly controversial. In 2016, the then-chief economist for the federal mortgage giant Freddie Mac warned that rising seas “appear likely to destroy billions of dollars in property and to displace millions of people.” By 2045, more than 300,000 existing coastal homes will be at risk of flooding regularly, the Union of Concerned Scientists concluded in 2018.

The question that has occupied researchers is how soon, and how quickly, people will respond to that risk by demanding price discounts or fleeing the market. Previous research has begun to tackle that question, showing that climate change, far from being a distant threat, is already starting to hurt real estate values."

"Then, starting in 2013, something started to change. While sales in safer areas kept climbing, sales in vulnerable ones began to fall. By 2018, the last year for which Dr. Keys and Mr. Mulder obtained data, sales in vulnerable areas trailed safer areas by 16 percent to 20 percent.

A few things happened around that time that might have made prospective home buyers more worried about climate risk, Dr. Keys said. An international report the previous year highlighted the risks of extreme weather events. After that report came out, Google searches in Florida for “sea level rise” spiked.

And people from the Northeast, who account for a significant portion of Florida home buyers, had just lived through Hurricane Sandy, which damaged some 650,000 homes and caused 8.5 million people to lose power, some for months."

Go to NYT original full length story

Related: I’m an American Climate Emigrant (excerpts): Sierra